CollegeChoice.net is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

Turn Your Dreams Into Reality

Take our quiz and we'll do the homework for you! Compare your school matches and apply to your top choice today.

If money makes the world go round, then accountants keep the spinning in order.

We all know not to throw a $20 bill on the ground, but accountants also know what to do with that money instead. Accountants help individuals or whole companies both protect and grow their money in safe, legal ways.

Accountants can be lifesavers, especially as April 15 approaches. Balancing the books, writing checks, and paying employees produces a deep sense of satisfaction. Figuring out tax loopholes, catching a tax evader, or exposing the next Bernie Madoff would be amazing!

The exciting nature of this field is why we’ve put together rankings like the Best Online Accounting Degrees to help students looking to join this exciting line of work.

By the way, if you’re looking for Business & Management degrees, or MBA programs, we’ve created separate pages for those.

We all know not to throw a $20 bill on the ground, but accountants also know what to do with that money instead. Accountants help individuals or whole companies both protect and grow their money in safe, legal ways.

Accountants can be lifesavers, especially as April 15 approaches. Balancing the books, writing checks, and paying employees produces a deep sense of satisfaction. Figuring out tax loopholes, catching a tax evader, or exposing the next Bernie Madoff would be amazing!

The exciting nature of this field is why we’ve put together rankings like the Best Online Accounting Degrees to help students looking to join this exciting line of work.

By the way, if you’re looking for Business & Management degrees, or MBA programs, we’ve created separate pages for those.

Frequently Asked Questions:

- What Is Accounting?

- How Much Can I Earn by Studying Accounting?

- What Are the Requirements for a Career in Accounting?

Recommended Schools

What Do Accountants Do?

An accountant gathers, organizes, and interprets financial information. The accountant records every transaction, categorizes the type of transaction, and reports the results. Most businesses need at least one accountant—and usually more than one! The Big Four international firms employ a combined 887,850 professionals in accounting, auditing, taxation, and corporate finance.

Getting experience at Deloitte, PricewaterhouseCoopers, Ernst & Young, or KPMG practically guarantees employment anywhere else. Medium and large corporations maintain accounting departments, and law offices that often utilize forensic accountants to explore financial issues relating to legal cases.

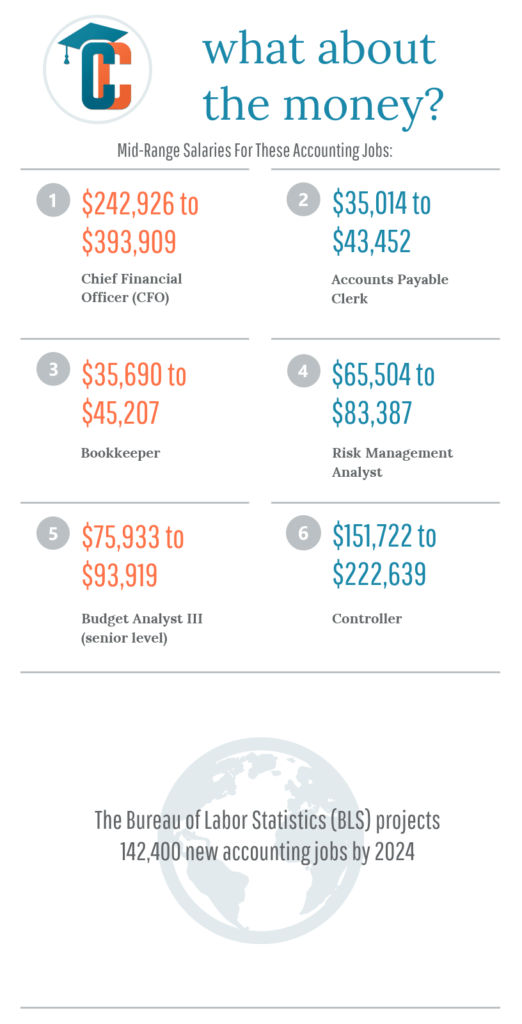

An accountant may also work as a bookkeeper or an accounts payable clerk, managing and organizing large sums of money. They may also become a risk management or budget analyst, looking at strategies for money management. And a highly skilled and experienced accountant can eventually transition into a role as a controller or a CFO.

Government agencies and offices also employ accountants. In fact, if you want to become a Special Agent in the FBI, the Bureau will even waive some of the eligibility requirements if you have licensure as a CPA.

A corporate entertainment accountant may land a job with a movie production studio and rub elbows with A-list celebrities.

Who said accounting was boring?

Most businesses need at least one accountant—and usually more than one! The Big Four international firms employ a combined 887,850 professionals in accounting, auditing, taxation, and corporate finance.

Getting experience at Deloitte, PricewaterhouseCoopers, Ernst & Young, or KPMG practically guarantees employment anywhere else. Medium and large corporations maintain accounting departments, and law offices that often utilize forensic accountants to explore financial issues relating to legal cases.

An accountant may also work as a bookkeeper or an accounts payable clerk, managing and organizing large sums of money. They may also become a risk management or budget analyst, looking at strategies for money management. And a highly skilled and experienced accountant can eventually transition into a role as a controller or a CFO.

Government agencies and offices also employ accountants. In fact, if you want to become a Special Agent in the FBI, the Bureau will even waive some of the eligibility requirements if you have licensure as a CPA.

A corporate entertainment accountant may land a job with a movie production studio and rub elbows with A-list celebrities.

Who said accounting was boring?

How Much Money Can You Make If You Study Accounting?

The Bureau of Labor Statistics (BLS) projects 142,400 new accounting jobs by 2024. This 11 percent rate of growth surpasses the national average for all career fields. The median salary in 2016 was $68,150. Most accountants hold Bachelor’s degrees, but some employers require a Master’s degree.

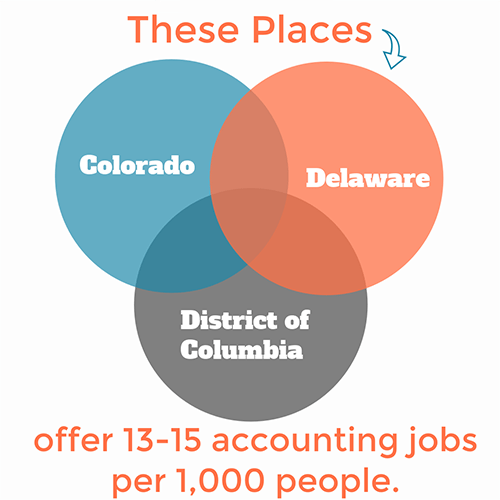

Accountants looking for jobs would find plenty of opportunities in the District of Columbia, Colorado, and Delaware, which offer 13-15 accounting jobs per 1,000 people. The District of Columbia also joins New York and New Jersey as the states offering the highest median salaries for accountants at just around $80,000.

But accountants also know that balance is important when it comes to money: Texas, Georgia, and Virginia offer the best ratio of median accounting salaries and cost of living.

surpasses the national average for all career fields. The median salary in 2016 was $68,150. Most accountants hold Bachelor’s degrees, but some employers require a Master’s degree.

Accountants looking for jobs would find plenty of opportunities in the District of Columbia, Colorado, and Delaware, which offer 13-15 accounting jobs per 1,000 people. The District of Columbia also joins New York and New Jersey as the states offering the highest median salaries for accountants at just around $80,000.

But accountants also know that balance is important when it comes to money: Texas, Georgia, and Virginia offer the best ratio of median accounting salaries and cost of living.

What Kind of Accounting Degrees Are Available?

The list starts off with an Accounting Certificate, which is available to undergrads looking to pursue entry-level accounting positions, such as Bookkeeping or Accounts Payable Clerk. Coursework typically covers intro courses in accounting and taxation, sometimes culminating in a final comprehensive exam. These certificate programs focus solely on accounting. An Associate’s degree takes two years and also leads to entry-level work. Coursework typically covers introductory accounting, business, and economics. A typical career choice with this degree includes Billing Clerk, Payroll Assistant, or Accounts Receivable Associate. Accounting is the primary focus of the program, but students are required to take courses in other areas. Those interested in this degree should check out our 50 Best Online Associate’s Degrees in Accounting ranking. However, the most common choice for those entering the accounting field is the Bachelor’s in Accounting. This four-year program covers taxation, auditing, communication, presentation, business law, macroeconomics, balance sheets, and cash flow. A Bachelor’s in Accounting is required for Certified Public Accountants (CPAs), as well as for forensic accountants, internal accountants, government accountants, and management accountants. College Choice has ranked the Best Bachelor’s in Accounting programs. There are a number of graduate options available, including an MBA with a concentration in Accounting, a Master of Accounting (MAcc), or a Master of Science in Taxation. These degrees help to prepare accountants for management and administrative roles. The MBA in Accounting covers a broader spectrum of topics than the MAcc. An MBA leads to senior roles in financial analysis and business administration. Classes cover accounting topics, as well as subjects such as organizational dynamics and global economic environment. The MAcc curriculum targets the knowledge needed to pass the CPA or CMA exam. These graduate students delve into research, valuation, auditing, consulting, managerial accounting, financial information systems, and cost management. These degrees require a commitment of one to two years, and are intended to lead to positions as a CPA (Certified Public Accountant) or a CMA (Certified Management Accountant). College Choice also has a ranking of the Best Master’s in Accounting Programs. Master’s in Accounting vs. MBA in Accounting: A regular Master’s in accounting gives accountants further expertise and experience in their own field and is generally for those looking to stay solely within the realm of accounting. An MBA in Accounting, on the other hand, will prepare accountants to take on management roles on top of their normal accounting duties.

The Master of Science in Taxation is intended for accountants looking to focus on taxation, and typically focuses on recent developments and evolutions in taxation. Graduates may pursue a career as a CPA or a Financial Advisor, or even as a company’s Chief Financial Officer.

Finally, scholars and researchers in the field of accounting may pursue their PhD in Accounting. These candidates conduct dissertation research and must defend their dissertation proposal. Doctoral students typically use economics and econometrics in investigations of accounting practices, and tend to pursue academic professions such as undergraduate or graduate level instruction upon graduation.

Note: a CPA must follow state regulations, which usually require 150 credit hours. A normal Bachelor’s degree caps at 120 credits. A dual Bachelor’s and Master’s degree (a five-year program) achieves this 150-credit threshold. Licensed accounting professionals usually need continuing education credits to maintain licensure.

Master’s in Accounting vs. MBA in Accounting: A regular Master’s in accounting gives accountants further expertise and experience in their own field and is generally for those looking to stay solely within the realm of accounting. An MBA in Accounting, on the other hand, will prepare accountants to take on management roles on top of their normal accounting duties.

The Master of Science in Taxation is intended for accountants looking to focus on taxation, and typically focuses on recent developments and evolutions in taxation. Graduates may pursue a career as a CPA or a Financial Advisor, or even as a company’s Chief Financial Officer.

Finally, scholars and researchers in the field of accounting may pursue their PhD in Accounting. These candidates conduct dissertation research and must defend their dissertation proposal. Doctoral students typically use economics and econometrics in investigations of accounting practices, and tend to pursue academic professions such as undergraduate or graduate level instruction upon graduation.

Note: a CPA must follow state regulations, which usually require 150 credit hours. A normal Bachelor’s degree caps at 120 credits. A dual Bachelor’s and Master’s degree (a five-year program) achieves this 150-credit threshold. Licensed accounting professionals usually need continuing education credits to maintain licensure.

What Accounting Specialties Are Available?

Under the banner of accounting, there are a number of specialties that students may pursue, based on their unique skills and interests. Tax specialists focus specifically on the ins and outs of state and federal tax law, working for individuals, small businesses, nonprofits, or large corporations. Tax accountants must have a bachelor’s degree, including coursework specifically related to taxation. Tax Accountants earn an average salary of around $53,000. Accountants may also pursue careers as auditors, who review and evaluate financial systems, employee performance, and organizational processes. One typically enters the field with a Bachelor’s degree, though Master’s degrees in the specialization are available. Financial auditors receive an average annual salary of around $64,000. Managerial accounting is another popular specialty. Students looking to enter these managerial positions, such as Corporate Treasurer or Comptroller, will typically pursue master’s degrees or CPA/CMA certifications, though some companies only require a bachelor’s degree. Managerial accountants start off their careers earning an average of around $70,000, after earning their CMA certifications.

Other niches and careers include business valuator, internal auditor, budget analyst, information systems auditor, financial manager, risk management, and revenue agent.

Professional licensures may be necessary in accounting specialties:

Managerial accounting is another popular specialty. Students looking to enter these managerial positions, such as Corporate Treasurer or Comptroller, will typically pursue master’s degrees or CPA/CMA certifications, though some companies only require a bachelor’s degree. Managerial accountants start off their careers earning an average of around $70,000, after earning their CMA certifications.

Other niches and careers include business valuator, internal auditor, budget analyst, information systems auditor, financial manager, risk management, and revenue agent.

Professional licensures may be necessary in accounting specialties:

- CPA (Certified Public Accountant)

- CGAP (Certified Government Auditing Professional)

- CGFM (Certified Government Financial Manager)

- CIA (Certified Internal Auditor)

- CISA (Certified Information Systems Auditor)

- CMA (Certified Management Accountant)

- CPP (Certified Payroll Professional)

- CrFA (Certified Forensic Accountant)

What Are the Best Accounting Degrees?

College Choice has put together rankings for a variety of different accounting-related degrees. Check them out below.Undergraduate Accounting

If there’s one thing that’s consistent every year, it’s the time when everyone hunkers down to file their taxes. And what does that usually lead to? A call to our accountants! These tax wizards are always in demand and a degree in accounting is an excellent choice if you’re looking for a career with high job prospects and a great salary to match. In fact, according to Forbes, Accounting remains one of the top degrees for getting hired in today’s job market. A Bachelor’s in Accounting will help prepare you to take the famously difficult CPA exam, and is actually required before you can sit for the exam. The US Bureau of Labor Statistics confirms the need for trained accountants – with a projected job growth rate of 11% between 2014 and 2024 – that is faster than average growth for all occupations. Accountants can also expect a median pay upwards of $65,000 a year. Whether you’re looking to work for a smaller company, a large business, or even the government, accounting jobs are always plentiful. Everyone needs a good accountant! College Choice has ranked the Best Online Associate’s Degrees in Accounting for those looking to obtain a quality degree with flexibility in their schedule. We’ve also ranked the Best Bachelor’s in Accounting Degrees, as well as the Best Online Bachelor’s in Accounting Degrees in the field.

College Choice has ranked the Best Online Associate’s Degrees in Accounting for those looking to obtain a quality degree with flexibility in their schedule. We’ve also ranked the Best Bachelor’s in Accounting Degrees, as well as the Best Online Bachelor’s in Accounting Degrees in the field.

Graduate Accounting

While an undergraduate degree in accounting will get you plenty far, an advanced graduate degree in accounting will open even more doors and potentially earn you significantly more money in the long run. Pursuing a master's degree in accounting will not only equip you with the basics, but also with all the skills needed to benefit you across the entire spectrum of business-oriented areas. With a master’s in accounting, you can expect to pursue the following careers: actuary, auditor, compliance manager, budget analyst, and more. According to Payscale.com, those with a master’s in accounting can expect to earn up to $80,000 and sometimes more, depending on the city and company. Senior accountants also report high levels of job satisfaction; with a salary like that, it’s easy to see why! College Choice has ranked the Best Master’s Degrees in Accounting. If you’re looking for flexibility without compromising quality, check out our ranking of the Best Online Master’s in Accounting Degrees. Perhaps you’re looking to save on your education; don’t miss our list of the Most Affordable Online Master’s in Accounting Degrees in this lucrative field. If you're keen on going the extra mile and want to pursue a PhD. in accounting, we have also ranked the Best Doctorate's Degrees in Accounting as well as the Best Online Doctorate's in Accounting Degrees.Actuarial Science

While the accounting field in general is good for those people who love numbers, the actuarial field in particular is a number-lover’s dream. Actuaries uses advanced statistical models to determine risk probability and the financial implications of those risks. They typically work for insurance companies to determine the terms of insurance plans, based on the likelihoods of sickness, disaster, accidents, and death. This is a very lucrative field--but you need the brainpower to do it. The federal government reports that actuaries earn a median salary of $100,610 per year. And you typically only need a bachelor’s degree to break into actuarial work. However, you’ll need to pass stringent exams and undergo intensive, on-the-job training in order to succeed. For those interested, luckily, the profession looks to have much faster than average job growth, at a full 18% over the next ten years. Up for the challenge of becoming an actuary? It will put all your brains and your work ethic to the test, but the rewards are enormous. You’ll have an intellectually challenging job, and one that pays well too. Take a look at our ranking of the Best Actuarial Science Degrees in order to get started on your journey.Forensic Accounting

Do you have a mind for numbers? Are you also interested in the intricacies of law? Dream of being an expert witness? Today, more and more law firms rely on forensic accountants to give expert evidence during trials. Forensic accountants not only utilize their accounting and auditing skills, but they also use their investigative skills to determine what events actually took place in a given financial setting. According to Payscale, forensic accountants generally work for insurance companies, banks, and government agencies. Folks in this field make, on average, $63,000 a year. Your pay can vary though based on experience and location. If you’re comfortable with numbers, research, and giving expert testimony in a court of law, you’ll be able to work your way up easily in this industry. Some forensic accountants even go on to open their own practices. There are plenty of opportunities and flexibility as a forensic accountant.Taxation

If “taxes” doesn’t make you cringe, a Masters in Taxation may be worth looking into! This highly specialized field of accounting is generally geared towards working professionals. Looking to move up to be a tax manager or a tax director? For those looking to gain further knowledge and gain more experience in the field, an advanced degree in taxation is key. According to Payscale, a tax manager can earn an average of nearly $100,000 a year. If that’s got you excited, keep reading. A senior tax manager can make over $125,000 a year, while tax directors make nearly $150,000 yearly. In fact, those with a Masters in Taxation earn 5-10% more than those with a masters in any field! Of course, salaries can range depending on your experience, location, and job title. The most popular and profitable cities for this career include New York, Chicago, Boston, Phoenix, and Los Angeles. Looking to pursue a degree in taxation? We’ve ranked the Best Master's in Taxation Degrees so you don’t have to scour the internet looking. If you’re hoping for a program that offers a bit more flexibility, check out the Best Online Master's in Taxation Degrees. For those looking the save money, there is the Most Affordable Online Master's in Taxation for you. The most common choice is the Bachelors in Accounting. This four-year program covers taxation, auditing, communication, presentation, business law, macroeconomics, balance sheets, and cash flow. A Bachelor’s in Accounting is required for Certified Public Accountants (CPAs), as well as for forensic accountants, internal accountants, government accountants, and management accountants.What Kind of Graduate Accounting Degree Should I Get?

Management and administration roles require Master’s degrees. There are a number of options available, including an MBA with a concentration in Accounting, a Master of Accounting (MAcc), or a Master of Science in Taxation. The MBA in Accounting covers a broader spectrum of topics than the MAcc. An MBA leads to senior roles in financial analysis and business administration. The MAcc curriculum targets the knowledge needed to pass the CPA or CMA exam. These graduate students delve into research, valuation, auditing, consulting, managerial accounting, financial information systems, and cost management. These degrees require a commitment of one to two years. The Master of Science in Taxation helps tax accountants keep abreast of crucial regulatory statutes. If you hope to climb the ladder in one of the Big Four firms, a Master’s is a necessity. Scholars and researchers pursue their PhD in Accounting. These candidates conduct dissertation research and must defend their dissertation proposal. Doctoral students typically use economics and econometrics in investigations of accounting practices. Others use psychology or sociology to observe the mind of the accounting professional. There may be a requirement to teach undergraduates. This program generally lasts four to seven years.- CPA (Certified Public Accountant)

- CGAP (Certified Government Auditing Professional)

- CGFM (Certified Government Financial Manager)

- CIA (Certified Internal Auditor)

- CISA (Certified Information Systems Auditor)

- CMA (Certified Management Accountant)

- CPP (Certified Payroll Professional)

- CrFA (Certified Forensic Accountant)

Who Hires Accountants?

Most businesses need at least one accountant—and usually more than one! The Big Four international firms employ a combined 887,850 professionals in accounting, auditing, taxation, and corporate finance.

Getting experience at Deloitte, PricewaterhouseCoopers, Ernst & Young, or KPMG practically guarantees employment anywhere else. Medium and large corporations maintain accounting departments, and law offices often utilize forensic accountants to explore financial issues relating to legal cases.

Government agencies and offices also employ accountants. In fact, if you want to become a Special Agent in the FBI, the Bureau will even waive some of the eligibility requirements if you have licensure as a CPA. Who said accounting was boring?

Most businesses need at least one accountant—and usually more than one! The Big Four international firms employ a combined 887,850 professionals in accounting, auditing, taxation, and corporate finance.

Getting experience at Deloitte, PricewaterhouseCoopers, Ernst & Young, or KPMG practically guarantees employment anywhere else. Medium and large corporations maintain accounting departments, and law offices often utilize forensic accountants to explore financial issues relating to legal cases.

Government agencies and offices also employ accountants. In fact, if you want to become a Special Agent in the FBI, the Bureau will even waive some of the eligibility requirements if you have licensure as a CPA. Who said accounting was boring?

Are There Any Other Options Out There For Me In Accounting?

Of course! The BLS and other data collectors mention dozens of subfields. There are cost accountants and investment accountants. If consulting interests you, consider becoming a personal financial advisor, a tax specialist, or a bookkeeper. Other niches and careers include business valuator, internal auditor, budget analyst, information systems auditor, financial manager, tax examiner, risk management, and revenue agent. A corporate entertainment accountant may land a job with a movie production studio and rub elbows with A-list celebrities. Sports teams build entire accounting departments and often hand out game tickets.Online College Resources

Helping you prepare and gain the most out of your educational experience.